55 8418..

California has a state-run disability benefits program for qualifying workers who have a short-term disability Typically benefits are paid for only 52. 3 Contribution and maximum benefit estimations based on the May 2023 Disability Insurance DI Fund Forecast Employment. Californias state disability insurance wage base and tax rate for 2023 were announced Oct 28 on the state employment development. The 90 wage replacement rate not to exceed the maximum workers compensation temporary disability indemnity weekly benefit. Y The 2023 ETT rate is 01 percent 001 on the first 7000 of each employees wages State Disability Insurance SDI y The 2023 SDI withholding rate is 09..

Your employer is allowed but not required to take a contribution from. Disability Benefits What are Disability Benefits Disability benefits are temporary cash benefits paid to an eligible employee when they are disabled by an off-the-job injury or illness. An employees contribution is computed at the rate of one-half of one percent of their wages but no more than sixty cents a week WCL Section 218 of the DBL. In New York State disability benefits provide financial support to individuals who are unable to work due to a disability However not everyone is eligible to receive these. To be required to have DBL coverage for its employees a company must employ at least one person besides the proprietor within the state..

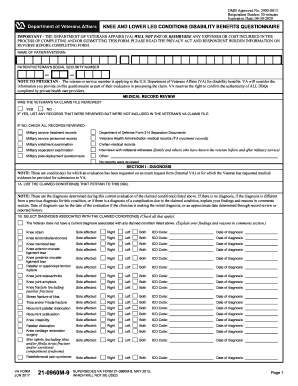

August 30 2022 6 min read Why trust us How do you file for disability in Florida. Wwwbenefitsvagovbenefitsfactsheetsaspor call toll free 800 827-1000 The programs processes and criteria for..

Comments